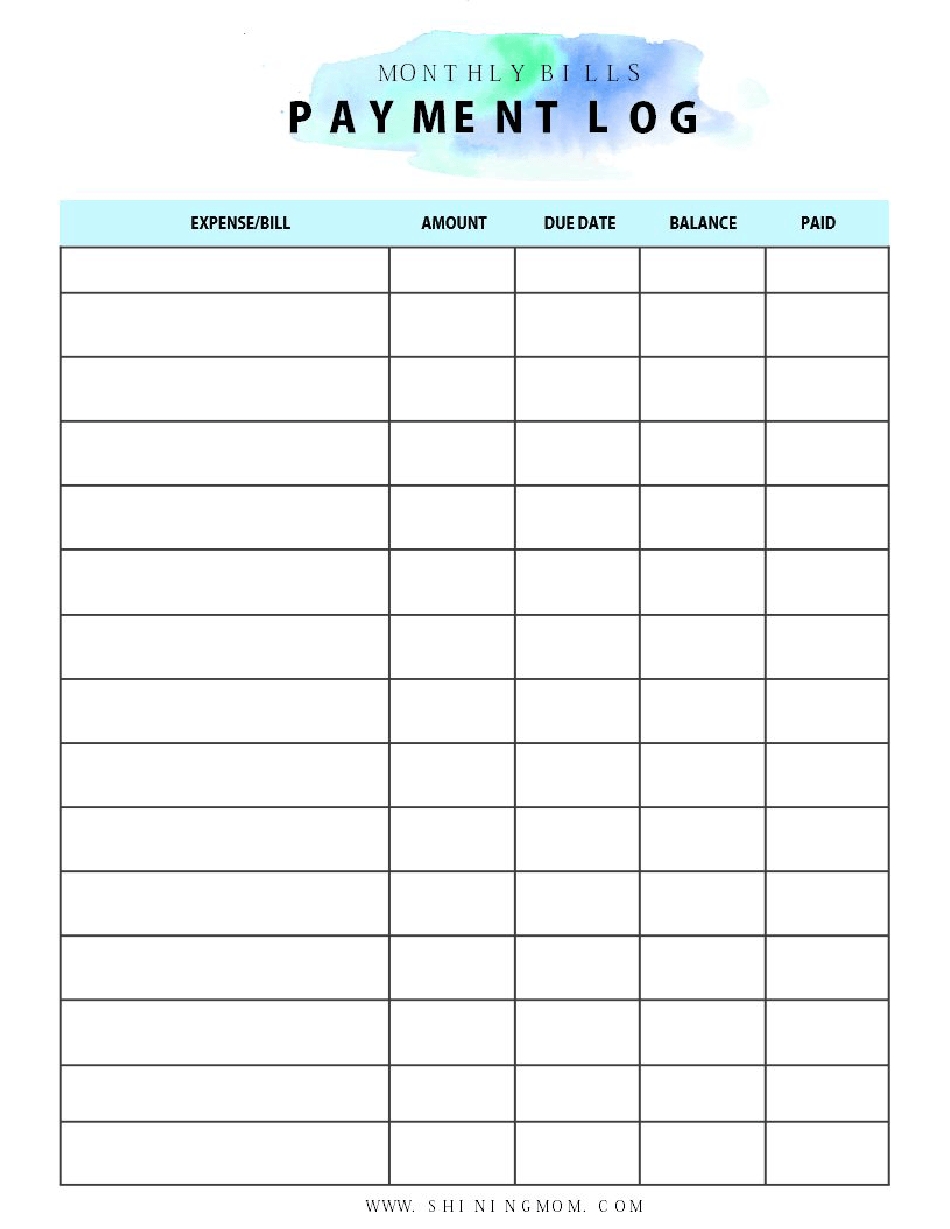

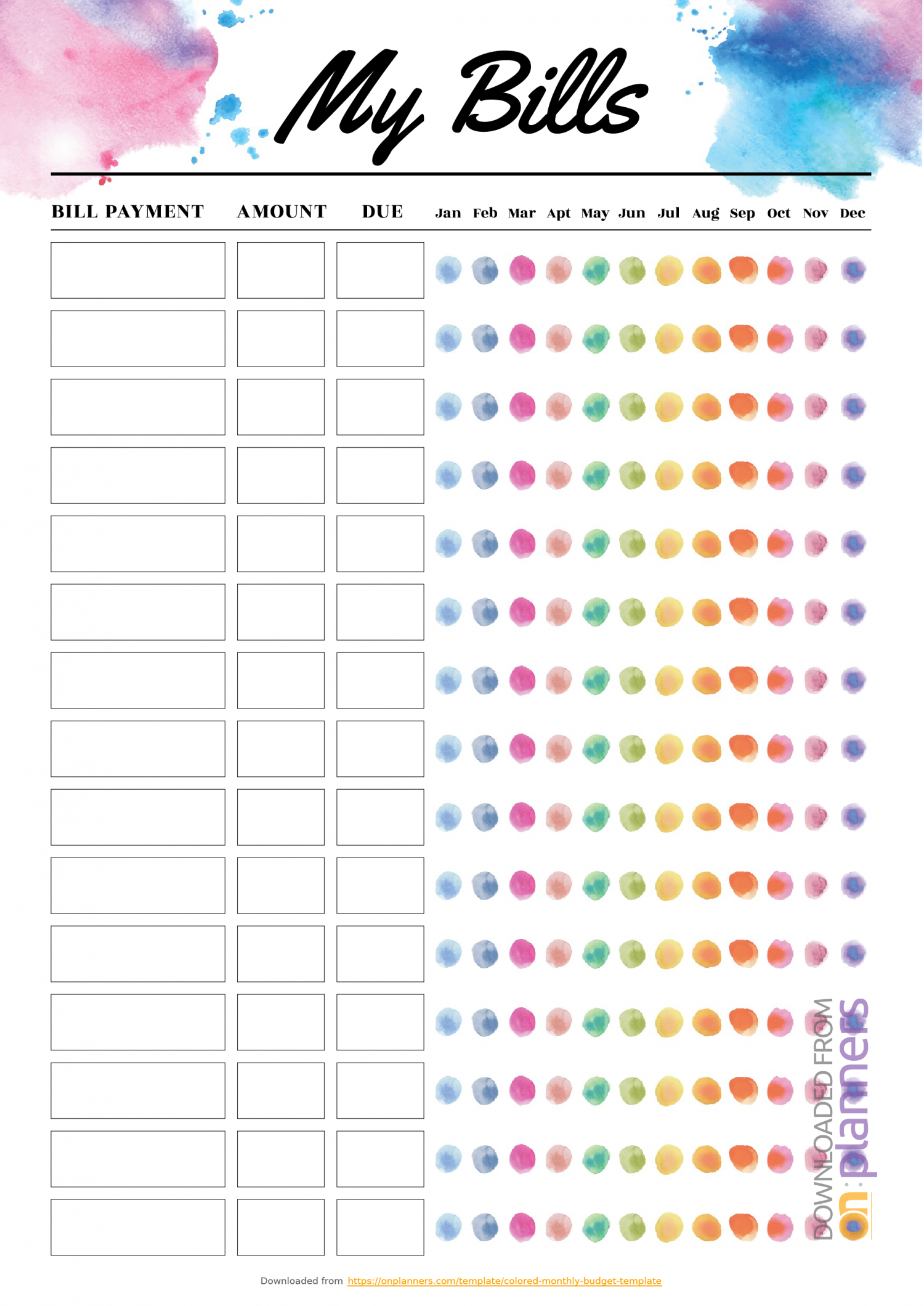

Once you have your budget filled out, put it where you will see it and can refer to it often-planner, vision board, on the fridge, on the mirror. Compare your total income to your total expenses and savings goals. Fill in your monthly bills (all your bills, including debt payments)ĥ.

#Monthly expenses list printable free

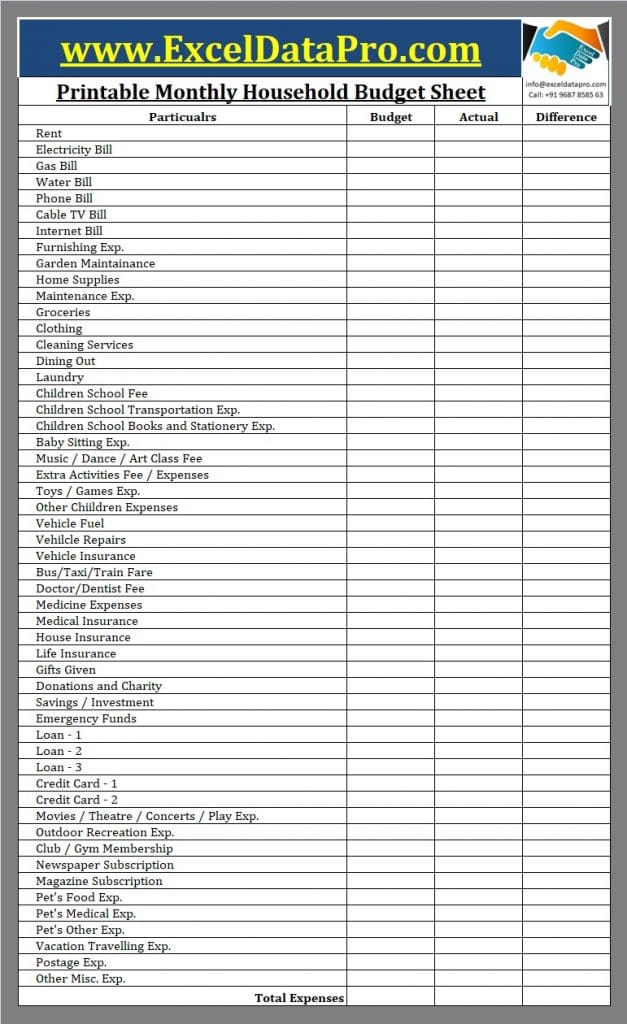

Print out the free printable template of your choiceģ. I promised you using a budgeting printable would be easy. Plus, physically writing things down make them stick better in your brain. But when just starting out, nothing beats seeing your finances in front of you in black and white. Using online templates or an excel budget are great once you get a better handle on your finances. When you are just getting started on budgeting, I always suggest start with pen and paper. Using a template allows you to really “see” your money-what you have coming in and where it is going out. Templates also help you to keep track of your income, expenses, debt payments and savings goals. You literally fill in the blanks on the page and watch your budget come to life. Money Envelopes–Make Budgeting work for you!Ī budget template is a simple worksheet that you print out and then use to create the budget for your family. If you need help getting started with your budget, here are some great resources! And it just gives me one less thing to worry about! It helps us to stay organized and better understand where our money is going. We still use a budget template for our personal finances each and every month. That is why I went on a search to find you some great FREE resources in the form of free budgeting templates. Then a budget is what you need! And creating a budget is super easy when you use a printable budget template.Īnytime we can make life a little easier, I am all for it! The above mentioned stakeholder organization is responsible for the distribution of this document.Free Printable Budget Worksheets to help you get startedĪre you ready to take control of your finances? Are you ready to stop wondering where your money went and start making progress on your financial goals? CMHC stakeholders are permitted to distribute the materials at their expense. Neither CMHC and its employees nor any other party identified in this Article (Lender, Broker, etc.) assumes any liability of any kind in connection with the information provided. The information is believed to be reliable, but its accuracy, completeness and currency cannot be guaranteed. It does not provide advice, and should not be relied upon in that regard. The information is provided by CMHC for general illustrative purposes only, and does not take into account the specific objectives, circumstances and individual needs of the reader.

#Monthly expenses list printable professional

Ask your mortgage professional about CMHC.

CMHC is Canada's largest provider of mortgage loan insurance, helping Canadians buy a home with a minimum down payment starting at 5%. Make sure you add these other costs when you fill out this form.įor more homebuying tips, visit CMHC's interactive Step by Step Guide. Note: You may have other costs not shown on this worksheet. DetailsĮntertainment, eating out, recreation, moviesĭental expenses, medical expenses, prescriptions, eye wear Use the following worksheet to help develop your budget. If you continue to spend more than you make, you must find ways to spend less. You should watch what you spend each month and see if you are getting closer to meeting your financial goals. Preparing a monthly budget - and sticking to it - is one of the keys to successful homeownership. Other funding and financing opportunities.Federal/Provincial/Territorial housing agreements.The National Housing Strategy Glossary of Common Terms.Indigenous and the North Housing Solutions.Connect with a housing solutions specialist – multi-unit.

0 kommentar(er)

0 kommentar(er)